5 Tips to Manage Local Listings for Financial Services Companies

Table of Contents

Seventy-eight percent of people search for local businesses more than once a week. In fact, 46 percent of all Google searches are linked to something local. When a potential customer searches for a local financial services company, what will they find?

Local searches should lead to information such as your company’s hours of operation, address, products, services, etc. Local listings management can help you control the information potential customers find online about your locations.

This blog will dive into how your financial services company can optimize its local listings to boost your online presence and win more customers, all while maintaining the necessary compliance standards.

What are Local Listings?

A local listing is today’s digital version of a Yellow Pages listing. It’s when an online directory mentions your local business. These local listings often include basic business information, such as your local business’s name, address, phone number, and a link to your website. Some directories will include customer reviews or payment options that you accept.

Tips For Local Listings Management

Now that you understand what a local listing is and their importance, let’s look at what your financial services organization can do to strengthen them. These six tips are easy to implement into your own listings management strategy.

1. Choose Which Platforms to Focus On

Before creating local listings, your financial services company must first decide which listing platforms it should have a presence on. While there are thousands to choose from, Google Maps and Search , Apple Maps, and Facebook are necessary.

Undoubtedly, Google is the most popular search engine receiving more than 86 percent of the search market share. Therefore, it’s most important to have a Google Business Profile (GBP), which appears on Google Search and Maps.

Although often considered a social platform, Facebook receives more than 1.5 billion monthly searches.

In addition to these top listings platforms, there are also industry-specific directories your financial services company should consider, such as the Financial Services Directory and the CPAdirectory, to name a few. Once you’ve decided which platforms you want your local listings on, you can begin claiming them.

2. Claim Local Listings Across Platforms

As a financial services organization with multiple locations, each location must have a local listing. The process for claiming a local listing can vary depending on the directory, but here you’ll find a guide for claiming your local listing on Google.

If you have already claimed all of your local listings, ensure that your business doesn’t have duplicate listings. If you find that someone else has already claimed one of your listings, you can report duplicate listings your company doesn’t own to Google and other directories.

3. Optimize Your Local Listings

Once you claim your local listings, it’s time to optimize them. The most important information each local listing should include is the location’s name, address, and phone number (NAP).

If potential customers see conflicting or inaccurate information, that can hurt your business’s reputation and local SEO. Similarly, if the information is consistent across all local listings, search engines are more likely to show your local listing in relevant searches, boosting online visibility.

Once you’ve updated your local listings with your NAP information, it’s time to add more details. The more a potential customer can find out about your business without having to do additional research, the better!

Other details your business should include, if applicable, are:

- Links to local social media pages

- Payment forms accepted

- A business description

- Attributes (identifies as veteran-led, wheelchair accessible entrance, dogs welcome, etc.)

- Additional media (videos, photos of your location, and more)

4. Include a Call to Action

This might sound simple, but adding a call to action (CTA) on your local listings can go a long way. CTAs allow your company to collect information about a potential customer without them navigating off your local listing. As a financial services company, a CTA like “Schedule an Appointment” or “Book a Phone Call” can increase lead conversion.

As mentioned, convenience is essential, and adding a CTA to your local listings provides this. Think of all the potential customers you could miss if your financial services organization isn’t collecting leads through a CTA.

5. Manage Your Reviews

The previous steps will ensure your local listings are optimized for users and search engines, but you can’t forget about reviews. Customers can leave reviews on your local listings, and many listings directories showcase these reviews. It isn’t enough to simply receive reviews. You must respond to them as well.

The data speaks for itself. Among consumers that read reviews, 97 percent read the business’s response to the reviews. Regarding negative reviews, 87 percent of consumers express a willingness to change a negative review, depending on how the business responds.

Your financial services company should respond to as many reviews as possible in a timely and personalized manner. If your company is not responding to reviews, customers will take notice.

For more tips on reputation management and responding to reviews, download our Multi-Location Marketer’s Guide to Online Reputation Management.

Financial Services Companies and Local Listings

While updated and accurate local listings are a must for financial services companies, wouldn’t it be helpful to understand how much others in your industry are leveraging listings? Our 2022 Localized Marketing Benchmark Report can help!

The report looked at how localized marketing leaders in various industries are performing in local search, social, and reputation management. When looking at local search and local listings specifically, the report found that the top multi-location financial services companies have claimed an average of 84.3 percent of their local listings with an average profile completeness of 72.3 percent.

Both of these averages were lower than the overall 2022 benchmark for all industries, providing an opportunity for financial services companies who do leverage and optimize their local listings to stand out from competitors.

Strengthen Your Local Listings Today

While it’s clear that updated local listings can positively impact your business’s online visibility, we understand that managing local listings across 100s or 1,000s of business locations can be daunting, especially when you have to take compliance into consideration.

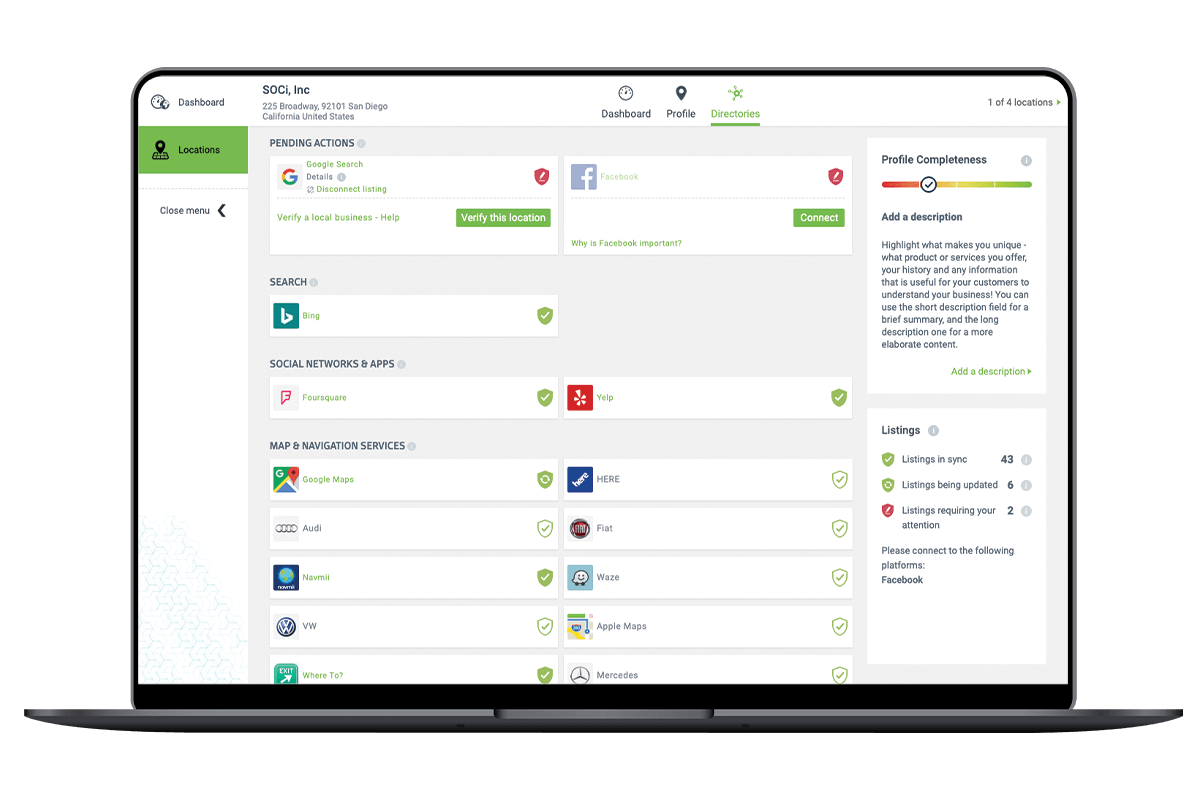

SOCi has a combination of listings and social products with compliance and archiving features for financial services companies such as SOCi Listings.

SOCi Listings will help your company increase your listings’ data accuracy and improve local search rankings, resulting in stronger brand awareness and visibility. Learn how to easily maintain accurate, consistent listings across all your locations with SOCi Listings. You can also get more insight into SOCi’s social compliance solutions from our blog on the topic.

For more information on how SOCi can help your financial services organization create a comprehensive localized marketing strategy and optimize your local listings to their fullest potential, request a demo today!