Why Multi-Location Financial Services Companies Need Local Social

Localized content receives 12x the engagement rate of more general or “non-localized content,” especially on social media. This localized content on social media is called “local social.”

Surprisingly, most multi-location financial services companies don’t focus on localized marketing, much less local social. Often because of compliance fears and not having a localized multi-location marketing strategy or software in place.

In this blog, we’ll define what local social means, discuss its benefits and ROI, and explain how SOCi can help get your local social strategy off the ground while maintaining compliance at every level.

What is Local Social?

To understand what local social is, we need to first define localized marketing. Localized marketing promotes your business and brand to a targeted area and community. For instance, how you market and connect with an audience in Washington will differ from how you’d engage with your target audience in Georgia.

Local social is the social media arm of localized marketing. Local social uses social media platforms to connect local branches or agents with local consumers to create a sense of community, improve brand awareness, and generate more sales.

Benefits of Local Social

Below are three main benefits of local social for financial services companies and beyond. All three impact brand awareness and drive revenue.

1. Make More Local Connections

Local social produces another avenue for location managers and agents to practice social selling. Local social selling is when agents or business locations use their local social profiles and networks to proactively engage with new leads in their communities and turn them into repeat customers.

A local social strategy allows each branch and its agents to amplify their brand and message on social networks at the local level in a more personalized manner.

2. Improve Local and Overall Business Growth

As your local agents and managers make these connections, they’re gaining more customers and generating local business, which raises the business’s overall profit.

3. Outpace Competitors

Since competitors may not have a local social media presence or strategy, it’s an opportunity to get ahead of them quickly.

Once you obtain a customer and build a rapport, you’ll gain their trust and loyalty. According to Acquia, 59 percent of American consumers stated once they’re loyal to a brand, they’re loyal for life. So, it’s important to gain new customers and build loyalty early on if you want to beat out competitors.

Where Financial Services Companies Rank in Local Social Today

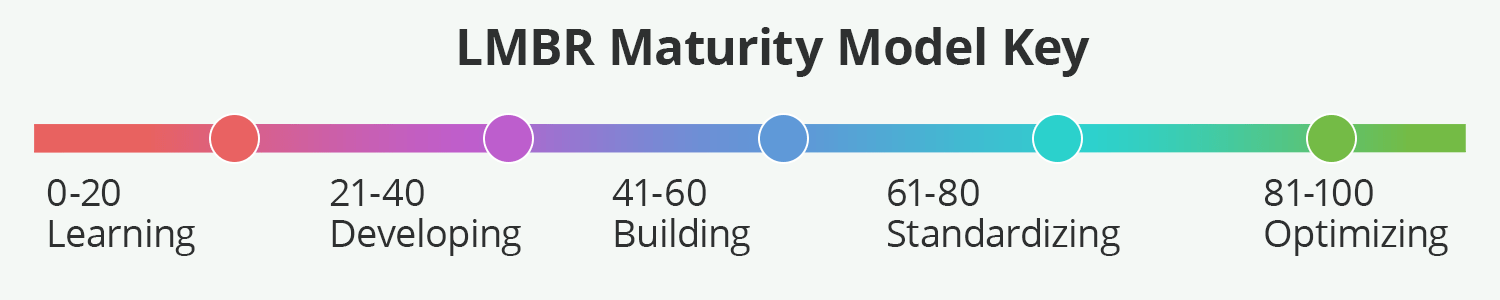

Our 2022 Localized Marketing Benchmark Report (LMBR) examined how top multi-location brands perform in the most influential local channels: local search, reputation, and local social. Businesses and industries are scored on a scale of 0-100 on their performance in each of the three categories.

Multi-location financial services companies average a local social score of 35. For reference, the local social benchmark for all industries is 46.

Thus, financial services companies are still establishing their local social strategies. They need to spend more time optimizing local social profiles and building an audience on social networks.

Now is the opportunity to stand out from the competition with a robust local social strategy. Download our 2022 LMBR for a complete insight into how financial services businesses are doing in localized marketing and local social, along with which industries are leading the way, and how.

How SOCi Helps Local Teams

SOCi’s social compliance solutions is a combination of our Listings and Social products with compliance and archiving for financial services companies.

Together, these products will enhance local social media visibility and performance by enabling local users to publish social posts while ensuring consistent corporate branding and regulatory compliance.

Centralized Place to Access and Produce Localized Content

SOCi offers one centralized solution that eliminates the guesswork for local users when publishing social content. You can now confidently commit to local social selling and gain more business.

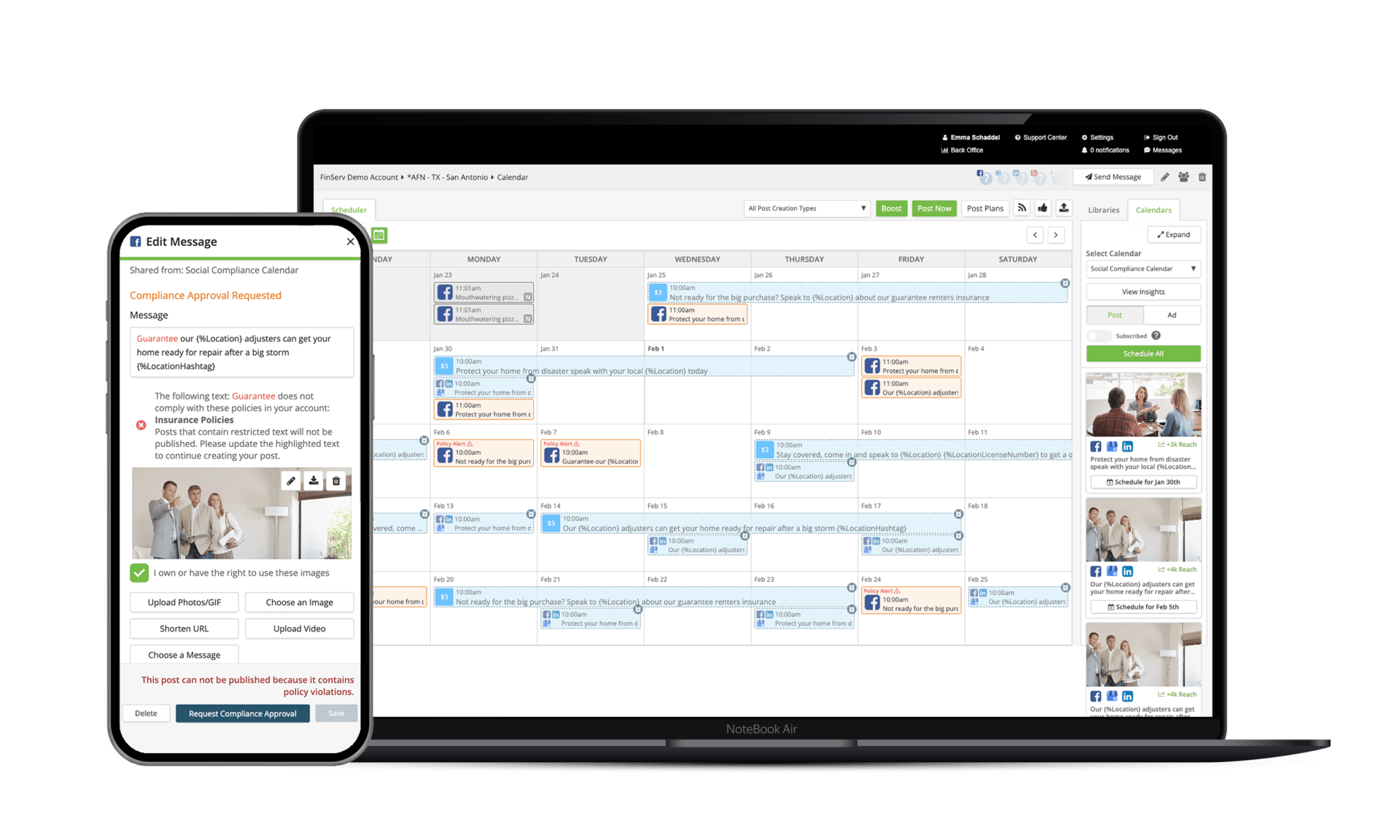

With SOCi Social, both corporate and local members have access to shared content libraries full of localized creative assets. These libraries simplify scheduling posts at scale through an easy-to-use and streamlined workflow.

How SOCi Helps With Compliance

Financial services must often adhere to regulatory compliance policies set by regulatory authorities, such as FINRA, FDIC, and the SEC.

Therefore, corporate-level teams must enable local-level professionals or agents to post regulatory-compliant content and educate local users on best practices. Both local users and corporate teams need immediate notifications when content doesn’t adhere to compliance standards. They also need the ability to make adjustments quickly when issues arise.

Here’s how SOCi can help your financial services business improve your local social strategy while maintaining compliance.

Automate Content Supervision With Keyword Policies

Most businesses have brand guidelines that corporate and local employees must adhere to. For financial services companies, these guidelines are imperative.

SOCi’s social compliance solutions helps local users and marketers mitigate the risks associated with non-compliance and brand inconsistencies. With SOCi’s social media management solution, you can oversee every social post across all locations published via SOCi or the native network.

SOCi also has automated keyword-based policies to assess and monitor compliance risks. You’ll be notified immediately via an email or push notification if local social content breaks one of your brand or compliance guidelines.

These automated notifications allow you to quickly adjust to avoid license suspensions and legal fines. It also removes the time-consuming process of manually reviewing each piece of content that an agent or business location produces.

Approved Workflows

Along with keyword policies, SOCi offers easy-to-use approval workflows. These workflows provide additional measures to improve compliance and save time.

For instance, group-level workflows allow multiple managers or corporate team members to approve content, increasing efficiency and brand consistency. There are also opt-in calendars that pre-populate with corporate-approved localized content.

These approval workflows simplify how you create and manage content so your teams can quickly get high-quality content in front of consumers and begin relationship building.

Complete Record of Social Media Activity

Financial services companies must maintain a complete record of social media activity for potential audits, mergers, or acquisitions. SOCi allows you to record and track all published social media content and activity, such as engagements or responses to consumers or other online users.

Having all content and engagements in one centralized place also helps you maintain a unified brand image and adhere to brand standards at the corporate and local levels.

For more information on how SOCi can help improve your multi-location business’s local social efforts while adhering to brand and compliance standards, request a demo today!