How UGC Can Take Your Financial Services Company to the Next Level

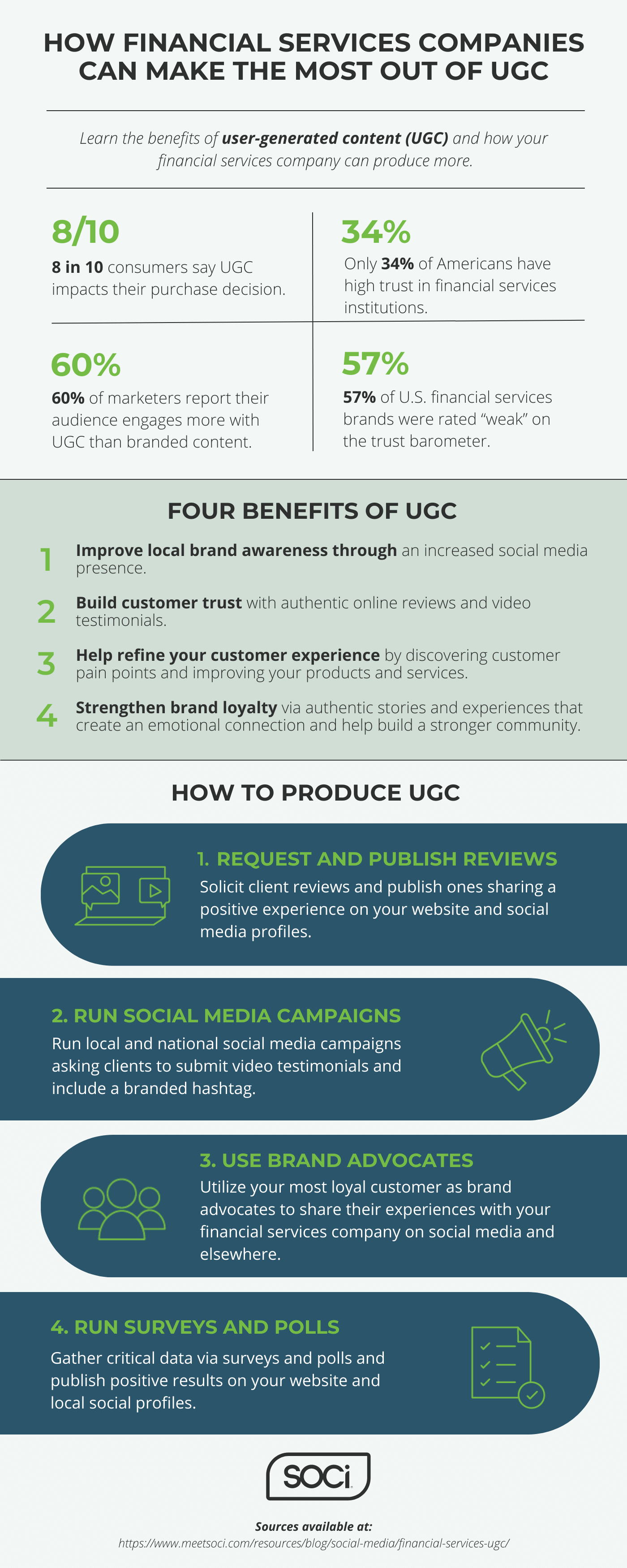

According to a recent study, only 34 percent of Americans have high trust in financial services companies. The same study found that nearly half of Americans believe it’s best to have a relationship with only one or two financial services.

As a financial services company, you must build trust with consumers to be one of their primary financial services. One way to improve trust and strengthen your relationship with current and potential clients is through user-generated content (UGC).

Within this article, we’ll define UGC, explain how to produce it, and discuss the benefits your financial services company can get from leveraging UGC.

For a quick summary, check out our infographic below.

What is User-Generated Content?

Table of Contents

User-generated content (UGC) is any content such as reviews, images, videos, or testimonials that people, rather than financial services, create. Typically, UGC is unpaid or unsponsored.

Eighty percent of consumers say UGC (photos, reviews, comments) highly impacts their purchase decision. UGC is 6.6x more influential than branded content. As you can see, UGC is highly influential to consumers and can significantly impact your financial services company.

The Two Types of UGC

There are two types of UGC for financial services companies: Member and employee content.

Member content originates from clients via an online review, testimonial, or other positive reactions to your financial services company.

Employee content comes from, you guessed it, employees. New job or promotion announcements and endorsement posts about your company on LinkedIn are a form of employee UGC content. Another example is a positive review on Glassdoor that your marketing team turns into UGC.

In this blog, we’ll be focusing primarily on member content.

Four Ways to Generate UGC

Below are four ways to create influential UGC that will increase local and national awareness.

1. Request and Publish Reviews

Turning positive reviews about your local agents or businesses into social media posts or website blurbs is one of the easiest ways to produce UGC. To do so, your local agents and branches need to encourage customers to write reviews.

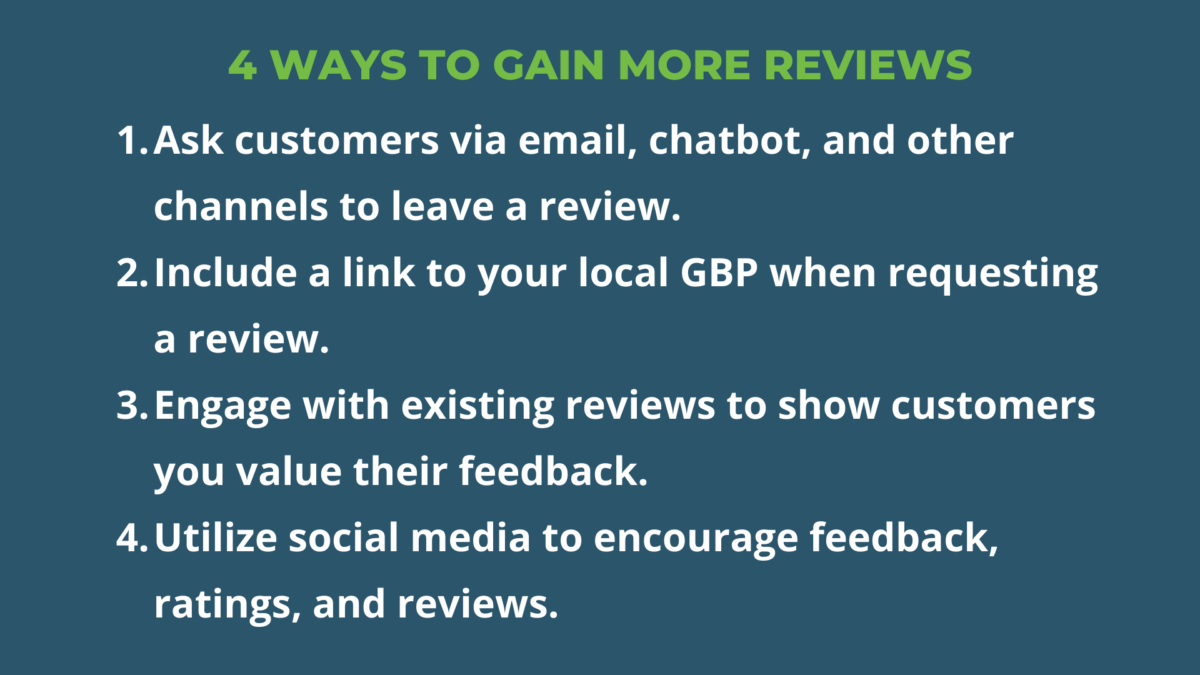

Here are a few ways to solicit reviews from clients:

With your most loyal customers, you can request video testimonials. Once you’ve received several positive written reviews or video testimonials, you can turn them into engaging user-generated social media posts or website content.

Utilize social media to encourage feedback, ratings, and reviews.

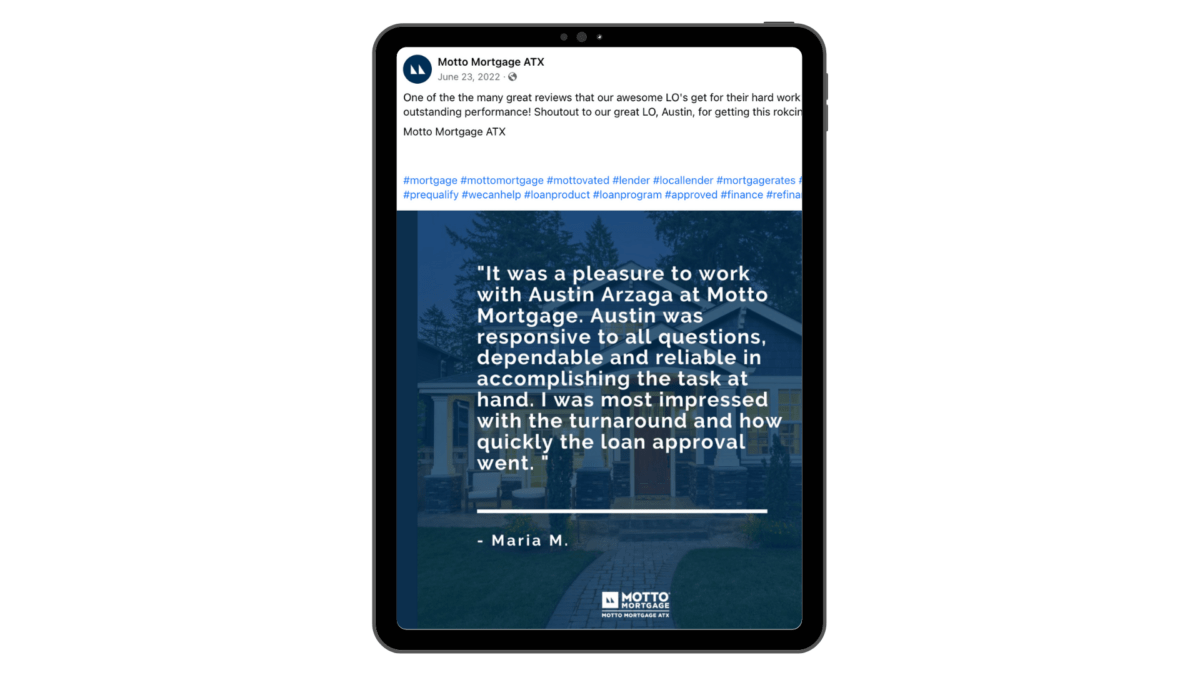

Below is an example of a review turned into an eye-catching social media post from Motto Mortgage:

2. Run Social Media Campaigns

Another way to produce UGC is to run social media campaigns. You can run these campaigns at the local or national level. For instance, a local branch can run a contest or giveaway for customers who submit a video testimonial describing their experiences with local agents.

You can also run a similar contest but have clients review your app or website. When it comes to products, ease of use matters. Sixty percent of U.S. consumers strongly prefer financial products that are easy to understand and use.

When running these social media campaigns, consider creating a dedicated company or campaign hashtag on social media platforms like Facebook, Instagram, Twitter, or LinkedIn. This hashtag also makes it easier for your marketing team to filter for and find UGC related to the campaign.

3. Incorporate Influencer or Brand Advocate Marketing

Another way to initiate more UGC is through influencer or brand advocacy marketing. Typically, influencer marketing involves paying social media influencers via cash, discounts, or deals to promote your financial services company.

The downside to paying influencers is that they almost always have to disclose their relationship with your financial services company and that you’re sponsoring them to post about you. You can utilize influencers; however, their relationship and disclosure can detract from the authenticity and won’t sway consumers as much as unpaid UGC.

Therefore, we recommend relying on brand advocates who are different from influencers. Brand advocates often don’t get paid for promoting your financial institution. They’re simply loyal customers willing to promote your local agents, branches, or products for free!

We recommend having brand advocates give video testimonials or writing social media posts endorsing your financial services company and specific agents they’ve worked with. Agents and branches can share these posts on their social media channels, and your company can repost them.

Note, even if you don’t pay brand advocates, we recommend they disclose their relationship as loyal customers with your financial services company.

You must adhere to the Federal Trade Commission’s (FTC) guidelines with all social media influencer and brand advocacy campaigns. According to the FTC’s Endorsement Guides, influencers need to make it evident that they have a “material” connection” or relationship with a brand. This relationship includes “personal, family, employment, or financial relationship — such as the brand paying you or giving you free or discounted products or services.”

4. Run Surveys and Polls

Surveys and polls are a great way to measure customer satisfaction and better understand customer pain points. You can also use positive survey results to publish UGC.

For instance, you can publish anonymous quotes from the surveys on social media or your website. You can also promote positive results such as, “According to our recent survey, our current customer satisfaction score is 8.9 out of 10. Click the link in our bio to learn more about our services!”

The Benefits of UGC

Now that you have an understanding of how to produce UGC, let’s discuss a few of its main benefits.

Improve Local Brand Awareness

When local consumers and brand advocates post on social media, they’re helping your financial services company get noticed. This tactic often improves your local brand awareness and helps you gain more clients.

Build Customer Trust

As mentioned earlier, consumers trust UGC much more than branded content. Producing a few pieces of UGC can help sway potential clients that are on the fence. Your UGC can be the difference between people choosing your financial services company over competitors.

Help Refine Your Customer Experience

By running UGC campaigns, you’ll discover customer preferences and pain points. When analyzing the data and trends, your financial services company can better understand your target audience and find ways you can improve your products and services. This insight will lead to a better customer experience for your clients.

Strengthen Brand Loyalty

Since UGC are real stories and experiences, they have the potential to create an emotional connection with your target audience. This content can lead to increased brand loyalty and a stronger community.

Furthermore, clients who see their online reviews or testimonials promoted will likely further gravitate toward your financial services company.

How to Ensure Your UGC is Compliant

Financial services companies must adhere to regulatory compliance policies set by regulatory authorities, such as FINRA, FDIC, FTC, and the SEC.

As a multi-location financial services institution, you must ensure corporate and local-level employees or agents post regulatory-compliant content.

SOCi’s social compliance solutions can help. In our social solution, our compliance features include the following:

Keyword policies: These keyword policies help minimize the potential for compliance and brand violations by local users when posting user-generated and other content on social media.

Compliance notifications: You’ll be notified immediately by a real-time SMS text or email notification if a non-compliant post goes live.

Approval workflows: These workflows allow managers or corporate team members to approve content before it’s published — providing an additional safety net.

Social archiving: Mitigate potential brand risk and be prepared for any audit with our social archiving tools.

Examine our infographic below for a summary of how financial services companies can best use UGC.

Request a demo today for more information on how SOCi can help improve your financial services company’s UGC and other local social efforts while following brand and compliance standards.

Infographic sources: Social Media Today | Insurance News Net | TINT | Forrester